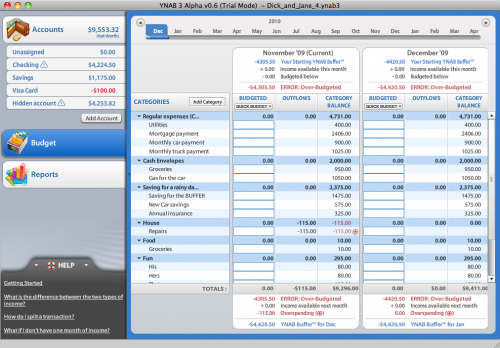

The first step involves estimating your expenses by entering amounts into predefined monetary events populated across five categories: Bills, Frequent, Non-Monthly, Goals, and Quality of Life. YNAB starts with a basic three steps to get set up, with useful explanations integrated into the interface (but little integrated help beyond that). A pop-up bar along the bottom guides you through three steps to set up your budget. Just set up your username and password, approve the terms of service, and you’re in. Signing up is simple, and doesn’t require a credit card to start. These scenarios really help drive home the why and how of YNAB’s benefit.

We really liked YNAB’s Help Center guidance, which not only helps you get started but gives tips based on what brings you on a journey to track a budget (such as, you’re doing a budget because you have debt or you can’t save money). Got more questions? You can use the pop-up interface to ask questions, and you’ll get a reply in 24-hours. The site has clearly organized documentation to walk you through setting up your budget in four steps. The Zooms cover everything from getting started to maintaining your budget and managing credit cards and debt set YNAB apart from the crowd. The jam-packed Help Center hosts blogs, videos, podcasts, and even live Zoom classes to introduce and complement the YNAB method and service.įor all its simplicity, using YNAB requires an understanding of the method behind the service, and the interactive classes are incredibly useful for delving deeper and getting your questions answered by a live human. The initial set-up guides you through the three basic set-up steps further help is found outside the service on the YNAB Help Center, or via the occasional in-service question mark. YNAB’s help and customized assistance is unparalleled.

#You need a budget review free#

College students get 12-months free after the 34-day trial.Īdditional tools help you track spending and savings goals, view spending and net worth trends, and navigate loan repayment (represented as another account).

#You need a budget review full#

Both plans have a 34-day trial period – clever and useful to showcase the impact the service can have across a full month and change. YNAB costs $14.99 billed monthly, or $8.25 per month billed annually at $98.99. 1 month plan - $6.99 per month ($6.99 total cost) (opens in new tab).Read the rest of our YNAB review to see if its price is worth it for you. However, it’s more expensive than the other best budgeting apps we reviewed. Generous guidance coupled with its clear focus on budgeting through managing income and expenses make YNAB the best budgeting app around. Those services, including Mint and Simplifi, offer budgeting as a part of a broad spectrum snapshot of your money management. YNAB’s singular focus is its strength, and sets it apart from the other personal finance services scrabbling for attention. The idea behind YNAB is to spend with intention, whereby you allocate your income to different expenses.

0 kommentar(er)

0 kommentar(er)